Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Retirement is a time to relax, explore new hobbies, and enjoy the fruits of your labor. But to truly make the most of your golden years, it’s important to have a solid financial plan in place. One of the key components of that plan is creating a retirement budget.

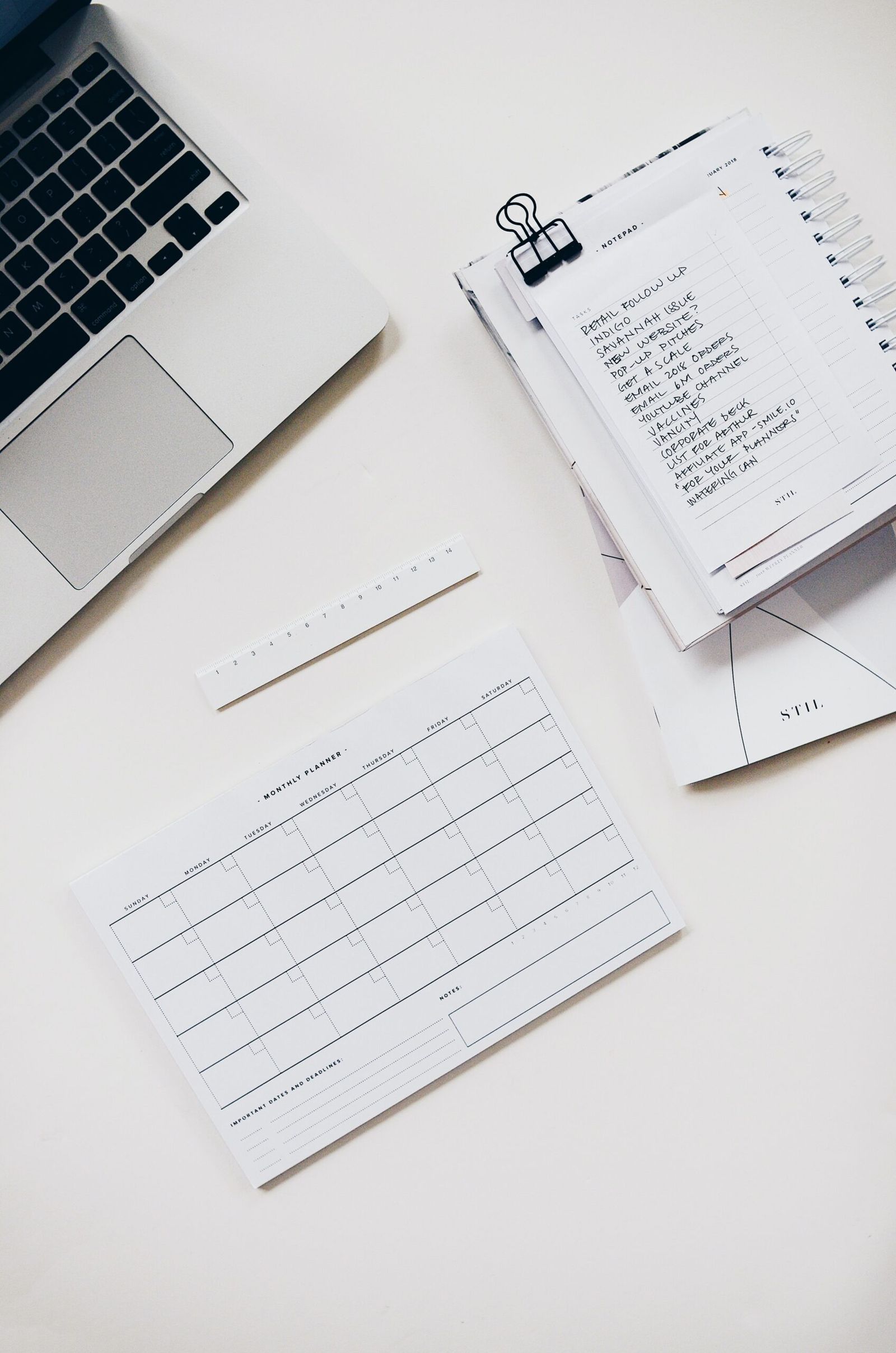

A retirement budget is a roadmap that helps you allocate your finances and plan your expenses during your retirement years. It allows you to maintain your desired lifestyle while ensuring you have enough money to cover your needs and unexpected expenses. Here’s a step-by-step guide on how to create and manage your retirement budget:

The first step in creating a retirement budget is to assess your current financial situation. Take a close look at your income, assets, and debts. Calculate your retirement income from various sources, such as pensions, Social Security, and investments. Determine your total assets, including savings, investments, and real estate. Also, consider any outstanding debts or loans that need to be repaid.

By understanding your financial situation, you can set realistic goals and expectations for your retirement budget.

Next, identify your retirement expenses. Start by categorizing your expenses into essential and discretionary categories. Essential expenses include housing, healthcare, groceries, utilities, and transportation. Discretionary expenses include travel, entertainment, dining out, and hobbies.

Consider any potential changes in your expenses during retirement. For example, you may no longer have commuting costs or work-related expenses, but you may have increased healthcare costs. It’s important to be thorough and realistic in estimating your expenses to avoid any surprises.

Once you have a clear understanding of your financial situation and expenses, it’s time to set your retirement goals. What kind of lifestyle do you envision for your retirement? Do you want to travel extensively or downsize to a smaller home? Define your priorities and set specific goals that align with your desired lifestyle.

Setting goals will help you make informed decisions when allocating your retirement budget. It will also give you a sense of purpose and direction during your retirement years.

Now that you have assessed your financial situation, identified your expenses, and set your goals, it’s time to allocate your retirement income. Start by allocating your essential expenses, such as housing, healthcare, and utilities. These should be given top priority to ensure your basic needs are met.

Next, allocate funds for discretionary expenses based on your retirement goals. If you have any debts or loans, allocate a portion of your income towards paying them off. Consider setting aside a portion of your income for emergencies and unexpected expenses.

Creating a retirement budget is not a one-time task. It requires regular monitoring and adjustments. Keep track of your expenses and income to ensure you’re staying within your budget. If you find that you’re overspending in certain areas, look for ways to cut back or reallocate funds.

Review your budget annually or whenever there are significant changes in your financial situation or goals. Adjust your budget accordingly to reflect any changes in income, expenses, or priorities.

Creating a retirement budget is a crucial step towards financial security and peace of mind during your golden years. By assessing your financial situation, identifying your expenses, setting goals, and allocating your income, you can effectively plan and manage your expenses.

Remember, a retirement budget is not set in stone. It’s a flexible tool that should be regularly monitored and adjusted to ensure you’re on track to meet your financial goals. With a well-planned budget in place, you can confidently embrace your retirement and enjoy the lifestyle you’ve always dreamed of.